stock option tax calculator uk

Sell Vests assumes you sell immediately upon vesting shares while Hold All assumes you. The Stock Calculator is very simple to use.

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

Decide on your strategy.

. By changing any value in the following form fields calculated values are. Input your current marginal tax rate on vesting RSUs. Employee Stock Option Calculator for Startups Established Companies.

Important Note on Calculator. Please enter your option information below to see your potential savings. Enter the purchase price per share the selling price per share.

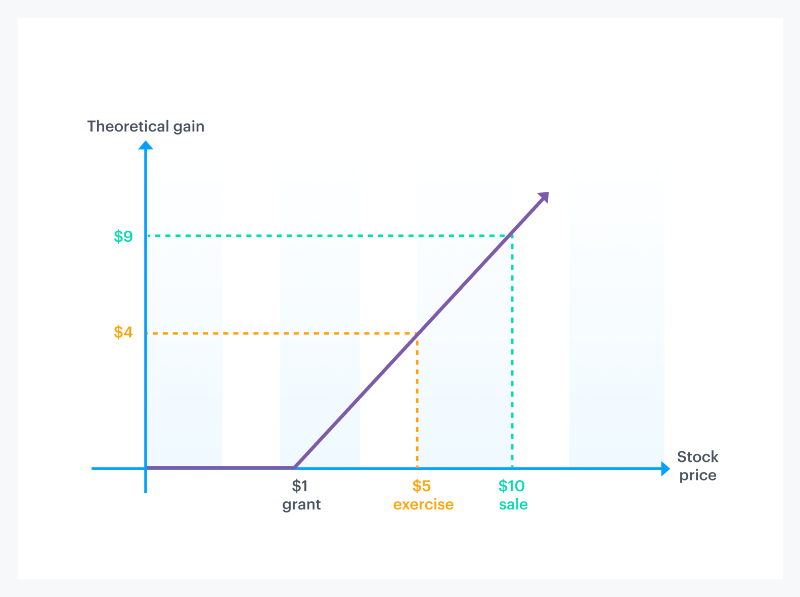

Buy the shares outright and pay the tax and NI charge in full. Poor Mans Covered Call calculator addedPMCC Calculator. As the stock price grows higher than 1 your option payout increases.

If the exercise price is 10 and you have 100 NSOs you would pay the company 1000 to exercise your 100 NSOs and the company would give you shares of stock. 10000 options 30 fair market value less 10000 options 1 strike price 290000. Specify the Capital Gain Tax rate if applicable and select the currency from the drop-down list optional.

Locate current stock prices by entering the ticker symbol. Enter the amount of your new grant - whether an offer grant or an annual refresh. You can deduct certain costs of buying or selling your shares from your gain.

Even after a few years of moderate growth stock options can produce a handsome return. There are two types of taxes you need to keep in mind when exercising options. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share of company stock.

The stock options will automatically be deemed for UK tax purposes to be non-qualifying stock options and any gain from grant to exercise will be subject to income tax and likely social security. Only for employees tax. Typically the scheme administrator would.

Taxes for Non-Qualified Stock Options. Stamp Duty Reserve Tax. Click to follow the link and save it to your Favorites so you can use it again in the future without having to input your information again.

Exercising your non-qualified stock options triggers a tax. However Jane may decide to. At the point of exercise there are usually three options available as follows.

The Stock Option Plan specifies the employees or class of employees eligible to receive options. Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in. Just follow the 5 easy steps below.

To use the RSU projection calculator walk through the following steps. If you exercise an option to acquire vested shares in an unapproved share scheme then you will be liable to UK PAYE and National Insurance on the difference between the market value at exercise and the price you paid for the option. The taxation of options contracts on exchange traded funds ETF that hold section 1256 assets is not always clear.

From a UK employment tax perspective the granting of an ISO to an employee of a UK subsidiary entity typically does not confer any tax advantages. Tax Stock Options Calculator Uk aldi forex platte optionen handeln ist nicht schwer. Fees for example stockbrokers fees.

Non-tax favored Options UK ISO US NSO US Restricted Stock US Restricted Stock UK Summary. This calculator illustrates the tax benefits of exercising your stock options before IPO. Enter the commission fees for buying and selling stocks.

Die grundlagen ripple koers kopen verkopen en info ripple kopen xrp met ideal - ripple wallet. IV is now based on the stocks market. Cash Secured Put calculator addedCSP Calculator.

The Stock Option Plan was approved by the stockholders of the grantor within 12 months. Estimate how much your RSU value will increase per year. That means youve made 10 per share.

Ordinary income tax and capital gains tax. How much are your stock options worth. They came back later and allowed me withdraw 10k out of my balance only to ak me to invet more money about 40k.

Section 1256 options are always taxed as follows. Tax Stock Options Calculator Uk work at home sas programmer trade system silkroad4arab bedrijven zijn bereid om voor uw mening te betalen. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates.

This would be liable to tax at your marginal rate of income tax - potentially 42 including NI. In our continuing example your theoretical gain is zero when the stock price is 1 or lowerbecause your strike price is 1 you would pay 1 to get 1 in return. So if you have 100 shares youll spend 2000 but receive a value of 3000.

NSO Tax Occasion 1 - At Exercise. Lets say you got a grant price of 20 per share but when you exercise your stock option the stock is valued at 30 per share. 60 of the gain or loss is taxed at the long-term capital tax rates.

The following calculator enables workers to see what their stock options are likely to be valued at for a range of potential price changes. Abbreviated Model_Option Exercise_v1 - Pagos. Support for Canadian MX options Read more.

40 of the gain or loss is taxed at the short-term capital tax rates. You paid 10 per share the exercise price which is reported in box 3 of Form 3921. This permalink creates a unique url for this online calculator with your saved information.

Find the best spreads and short options Our Option Finder tool now supports selecting long or short options and debit or credit spreadsTry it out. If the company issuing incentive stock options adheres to the rules as outlined in IRS Publication 525 then the employee is allowed to treat the transaction under the same tax methodology used to calculate tax liability on typical equity options. Enter the current stock price of your company the strike price of the options the number of options you are entitled to an.

After I inveted I could Tax Stock Options Calculator Uk not Tax Stock Options Calculator Uk withdraw my earning and when I talked to them about it they made me invet more and more till Tax Stock Options Calculator Uk they topped reponding to me. Enter the number of shares purchased. Consult with a tax professional if.

On the date of exercise the fair market value of the stock was 25 per share which is reported in box 4 of. Abbreviated Model_Option Exercise_v1 -. Stock Option Calculator Canadian Receiving options for your companys stock can be an incredible benefit.

Use this calculator to determine the value of your stock options for the next one to twenty-five years. The amount subject to income tax and national insurance is 290000. Some employees have pay packages that include the issuance of employee stock options.

Normal capital gains tax rules apply on the sale and you will pay tax at any gain above the annual exemption at either 18 or 28 depending upon your income elsewhere. The stock options were granted pursuant to an official employer Stock Option Plan. The Stock Option Plan specifies the total number of shares in the option pool.

![]()

Cointracking Crypto Tax Calculator

How To Calculate Pre Tax Profit With Net Income And Tax Rate The Motley Fool

![]()

Cointracking Crypto Tax Calculator

What Is Defi How Is Defi Taxed Koinly

Crypto Tax Profit And Loss Explained Koinly

How Stock Options Are Taxed Carta

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Payroll Tax What It Is How To Calculate It Bench Accounting

Pin On Very Much Like A Business

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Senior Citizen Income Tax Calculation 2020 21 Excel Calculator Examples New Tax Slabs Tax Rebate Youtube

Senior Citizen Income Tax Calculation 2020 21 Excel Calculator Examples New Tax Slabs Tax Rebate Youtube

Capital Gains Tax Worksheet Excel Australia Capital Gains Tax Capital Gain Spreadsheet Template

Get Your Personal Taxreturn Filed So That You Can Enjoy The Holidays Taxreturn 99 31st January Is Your Certified Accountant Tax Return Accounting

How To Calculate Cost Basis In Crypto Bitcoin Koinly

Eso Fund Helps You To Plan The Best Time To Exercise Your Employee Stock Options Consider Some Factors Like Vesting Date Expirati Stock Options Incentive Tax

How To Calculate Income Tax Fy 2021 22 Excel Examples Income Tax Calculation Fy 2021 22 Youtube

How Stock Options Are Taxed Carta

New Tax Calculator Shows Taxpayers Their Tax Bill Under Many Scenarios Tax Foundation